While attending to your physical injuries and seeking medical attention is of the utmost importance after an accident, once you have done so and the initial shock has worn off, the physical damage to your vehicle can loom large and be an undue source of stress during the early stages of your recovery.

Which Insurance Company fixes your vehicle

It is important to note that the property damage to your vehicle is not considered a component of your personal injury claim, and that the repairs are subject to the contractual relationship between you and your own insurance company. In Alberta, regardless of who is at-fault, when fixing your car you would deal with your own insurance company. Afterwards, they would recoup what they paid out for your claim from insurance company of the at-fault third party. This process is called subrogation, although it wouldn’t apply if the other driver didn’t have insurance. If so, your own policy would apply, provided you have collision coverage.

These elements tend to pull focus right after an accident due to their practical implications. While relatively normal, perceived delays in the process can cause frustration, but once the insurance company determines that your vehicle can be fixed – or if it is a total loss and they’ll pay you out – this signals that the matter will soon come to a resolution. However, sometimes there is a question regarding compensation for the loss in value to your vehicle because it was in an accident, regardless of it being repaired to factory standards. Your personal injury lawyer can help encourage the insurance company to fully fix your vehicle after a car accident or any type of motor vehicle accident (MVA) in Alberta.

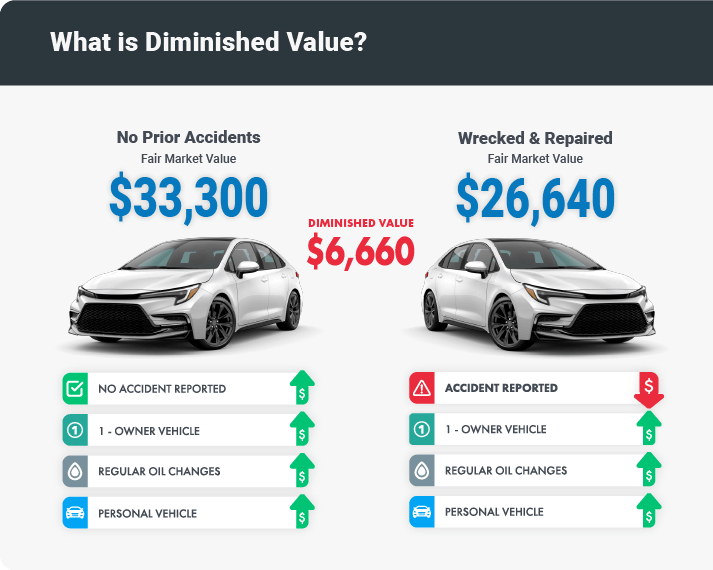

This is called diminished value or accelerated depreciation.

What is Diminished Value?

Diminished value is the difference between the fair market value of your car before the accident and its fair market value after the accident. It’s a real loss that can have a significant impact on your finances.

There are many factors that can affect diminished value, including the severity of the accident, the age and condition of your car, the demand for your car, and the type of repairs that were made.

If your car has been in an accident, it will still lose some value even if it has been repaired to the highest standards. Potential buyers are often unwilling to pay as much for a car that has been damaged.

Therefore, you would expect to receive less when you sell a damaged vehicle to a prospective buyer, as this would be disclosed on its vehicle history report and would fetch less in comparison to the same accident-free vehicle, all other things being equal. Diminished value can exist inherently simply from the stigma that the vehicle was involved in an accident. It can also be repair-related, like if generic parts were used instead of name brand components or flash after-market upgrades, or if cosmetic variations exist despite the car being otherwise restored.

There is no insurance coverage for diminished value claims in Canada. Auto insurance policies will only cover direct losses, and diminished value from an accident is considered an indirect loss. However, this does not prevent drivers from advancing these claims against the at-fault insurance company on their own through the court process, although diminished value is a relatively new head of damage with its own evolving body of case law. Insurance rules differ province to province, Alberta insurance rules are different than the insurance rules in British Columbia. You would be unable to pursue a court claim for diminished value from the at-fault driver’s insurance company in a no-fault jurisdiction, like Ontario, which restricts your ability to seek compensation from the driver who caused the accident. Alberta allows at-fault claims. But unfortunately, some of the provinces like Ontario are no-fault insurance, so they do not allow personal injury claims or any legal claim.

There have been some cases of people taking this matter to court in Alberta with varying success where they have sued the at-fault insurance company. Generally, courts have been hesitant to award diminished value claim. You as the plaintiff are responsible for meeting the burden of proving the claim. This can require incurring out-of-pocket expenses for things like filing fees and expert appraisal reports, which provide useful evidence but by no means guarantee success. The amounts typically claimed do not justify the additional cost of hiring a civil lawyer. Diminished value claims have been usually settled out of court by negotiations directly with the insurance companies,

Some of the important factors for assessing whether pursuing a diminished value claim is worth it can include the severity of the damage, as well as what was damaged, the age of the vehicle, its ‘prestige factor’, and the quality of the repairs. While there may be some inherent diminished value, depending on these factors, it may not be worth pursuing a claim unless your vehicle was fairly new when the accident happened, and/or a high-ticket luxury model.

Auto insurance policies will only cover direct losses, and diminished value or accelerated depreciation after an accident is considered an indirect loss. This is an evolving area of law, although to date courts have been hesitant when awarding damages in this regard, and settlements have typically occurred out of court.

If you have been in an accident and have questions about the claims process, contact an experienced personal injury lawyer to discuss how to maximize your claim. Moustarah & Company is dedicated to getting you the compensation you deserve. Moustarah & Company is centrally located in downtown Edmonton, and handles personal injury claims all over Alberta.